How Offshore Investment Can Assist Diversify Your Financial Portfolio Effectively

How Offshore Investment Can Assist Diversify Your Financial Portfolio Effectively

Blog Article

Everything About Offshore Investment: Insights Into Its Factors To Consider and benefits

Offshore financial investment has actually become a significantly relevant subject for individuals seeking to diversify their portfolios and improve monetary safety and security. While the prospective benefits-- such as tax optimization and property defense-- are engaging, they come with a complex landscape of threats and governing difficulties that require careful consideration. Comprehending both the benefits and the challenges is essential for anyone contemplating this investment method. As we explore the nuances of offshore investment, it comes to be apparent that notified decision-making is important for optimizing its prospective benefits while reducing inherent dangers. What aspects should one prioritize in this intricate environment?

Understanding Offshore Financial Investment

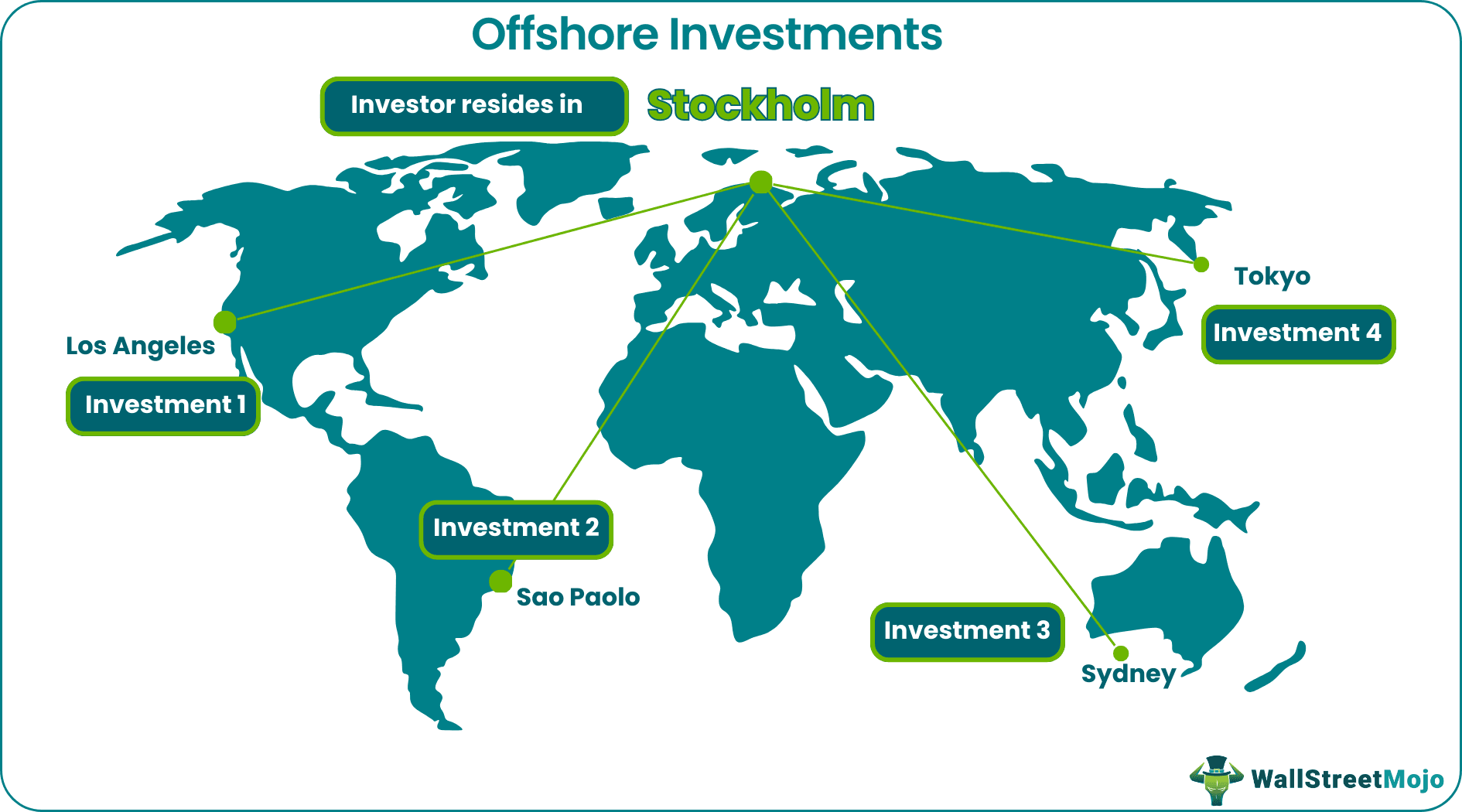

In the world of worldwide money, recognizing overseas financial investment is essential for people and entities seeking to optimize their monetary portfolios. Offshore financial investment describes the positioning of assets in banks outside one's country of residence. This technique is usually made use of to accomplish different financial goals, consisting of diversity, property security, and prospective tax advantages.

Offshore financial investments can include a broad selection of monetary instruments, consisting of supplies, bonds, mutual funds, and actual estate. Investors might choose to establish accounts in territories known for their positive regulative environments, privacy regulations, and economic stability.

It is crucial to identify that offshore investment is not inherently identified with tax evasion or illicit activities; instead, it offers legitimate purposes for many financiers. The motivations for participating in overseas investment can vary widely-- from looking for higher returns in developed markets to guarding assets from economic or political instability in one's home nation.

Nevertheless, potential investors should also be aware of the intricacies involved, such as conformity with global laws, the necessity of due diligence, and recognizing the lawful ramifications of overseas accounts. Generally, a detailed understanding of overseas financial investment is essential for making informed economic decisions.

Trick Advantages of Offshore Investment

Offshore financial investment supplies a number of essential advantages that can enhance a capitalist's economic approach. This can substantially enhance overall returns on investments.

In addition, offshore financial investments frequently give access to a more comprehensive array of investment possibilities. Capitalists can expand their portfolios with possessions that may not be easily available in their home nations, consisting of global supplies, actual estate, and specialized funds. This diversity can lower threat and enhance returns.

Furthermore, overseas financial investments can promote estate planning. They enable investors to structure their possessions in a manner that reduces inheritance tax and guarantees a smoother transfer of riches to heirs.

Usual Dangers and Obstacles

Spending in overseas markets can offer various risks and difficulties that need careful consideration. One significant threat is market volatility, as offshore financial investments might go through fluctuations that can affect returns considerably. Investors need to also be mindful of geopolitical instability, which can disrupt markets and impact financial investment performance.

An additional difficulty is money threat. Offshore financial investments frequently entail purchases in foreign currencies, and negative currency exchange rate movements can erode earnings or increase losses. Offshore Investment. Furthermore, restricted accessibility to trusted details concerning overseas markets can hinder educated decision-making, bring about possible mistakes

Lack of governing oversight in some offshore territories can additionally posture dangers. Financiers may find themselves in settings where financier security is minimal, raising the risk of scams or mismanagement. Differing economic methods and cultural mindsets toward investment can make complex the investment process.

Regulative and lawful Factors to consider

While browsing the intricacies of offshore investments, understanding the lawful and governing landscape is critical for safeguarding assets and making sure conformity. Offshore investments are typically based on a wide variety of regulations and policies, both in the investor's home nation and the jurisdiction where the investment is made. As a result, it is important to carry out extensive due persistance to comprehend the tax effects, reporting needs, and any lawful commitments that may emerge.

Regulatory structures can vary substantially in between jurisdictions, impacting whatever from taxes to resources requirements for foreign investors. Some countries may offer favorable tax obligation regimens, while others enforce stringent policies that can deter investment. In addition, international contracts, such as FATCA (International Account Tax Conformity Act), might obligate financiers to report overseas holdings, boosting the requirement for openness.

Financiers should additionally know company website anti-money laundering (AML) and know-your-customer (KYC) regulations, which need financial institutions to validate the identity of their clients. Non-compliance can lead to extreme penalties, including penalties and constraints on financial investment activities. As a result, involving with legal experts specializing in worldwide financial investment legislation is essential to navigate this complex landscape successfully.

Making Enlightened Decisions

A critical approach is necessary for making educated decisions in the realm of overseas financial investments. Comprehending the complexities included requires extensive study and analysis of numerous aspects, including market trends, tax obligation ramifications, and legal structures. Capitalists must examine their threat tolerance and financial investment objectives, making sure positioning with the special characteristics of offshore chances.

Performing due diligence is paramount. This includes examining the credibility of institutions, monetary see this site advisors, and investment vehicles. Inspecting the governing setting in the selected jurisdiction is vital, as it can substantially affect the safety and profitability of investments. In addition, remaining abreast of financial problems and geopolitical developments can provide valuable understandings that educate financial investment approaches.

Engaging with experts who specialize in offshore financial investments can additionally enhance decision-making. Offshore Investment. Their experience can guide financiers with the intricacies of global markets, aiding to identify possible challenges and rewarding chances

Eventually, notified decision-making in offshore investments depends upon a versatile understanding of the landscape, a clear expression of specific goals, and a dedication to ongoing education and learning and adjustment in a vibrant worldwide atmosphere.

Verdict

In final thought, offshore investment presents significant benefits such as tax optimization, possession defense, and access to global markets. It is critical to acknowledge the affiliated dangers, including market volatility and regulative difficulties. A thorough understanding of the legal landscape and attentive Your Domain Name research is vital for successful navigating of this facility sector. By resolving these considerations, financiers can efficiently harness the benefits of overseas financial investments while reducing possible disadvantages, ultimately leading to educated and tactical economic decisions.

Offshore financial investment uses several crucial advantages that can enhance a capitalist's economic technique.Additionally, offshore financial investments commonly provide accessibility to a wider range of financial investment chances. Varying financial practices and cultural attitudes toward financial investment can make complex the financial investment process.

:max_bytes(150000):strip_icc()/offshore.asp-FINAL-1-941110e2e9984a8d966656fc521cdd61.png)

Report this page